Beyond The Headlines

THANKS FOR THE MEMORIES!

Beware of “Experts” Who Mostly Know How to Rationalize What Has Already Been Happening

Famous quotes are difficult to attribute. Mark Twain may never have said that “history does not repeat itself but that it often rhymes.” Winston Churchill may have been paraphrasing George Santayana when he wrote that “Those that fail to learn from history are doomed to repeat it.” Still, with these maxims in mind, I have tried to recall a few investment episodes from my own experience when I learned something that would help me avoid future mistakes.

Some of these episodes were (or should have been) foreseeable. At the very least, common sense should have told us that trees do not grow to the sky. I would place these events in the Bubbles category. Examples are the “Nifty Fifty” craze of the 1970s in the United States, the outrageous valuations of Japanese equities and real estate during the 1980s, the dotcom folly of the late 1990s the U.S. sub-prime crisis of 2007 along with its aftermath, the Great Recession.

Other episodes have been less predictable, like the 1987 stock market crash in New York: I classify those as Minsky Moments, due more to the bipolar nature of investment markets than to traceable causes or events.

As Robert Armstrong, who writes the Unhedged column for the Financial Times, remarked on September 21, 2007, “In financial markets, prices lead and explanations follow.” Stock market historians and chroniclers often make a distinction between “smart” and “dumb” money, implying that the “smart” money is in the hands of Wall Street professionals while the dumb money belongs to the ignorant private investor crowd. In fact, the striking characteristic of many identifiable bubbles is the role that reputed experts and “professional” investors have played in justifying and bidding up exuberantly overpriced investment concepts.

THE NIFTY FIFTY EPISODE of THE EARLY 1970s

One memory is the role of advisers from leading banks in promoting shares of the early -1970s so-called Nifty Fifty companies as fool-proof investments because they had survived unharmed the relatively mild recession of 1970. Since it is easier to sell something that has already worked well, this feat was paraded by many professional advisers as proof that some companies, because of the resilience of their growth and the strength of their balance sheets, were recession-proof. Consequently, they claimed that these “one-decision” stocks should be purchased at any price and held forever.

No need to remind readers of what followed. Well-known names of then-successful companies with overpriced shares destroyed the dreams of many gullible investors. Xerox, traded for 49 times earnings in late 1972 before falling 71% from its 1972 high to its 1974 low. Avon, which had sold as high as 65 times earnings, fell 86% while Polaroid lost 91% from its high at 91 times earnings to its 1974 low.

Of course, those are among the worst examples of mindless investing in stock market leaders, but most of the Nifty Fifty suffered badly and many never recovered.

THE JAPANESE ASSET BUBBLE of THE 1980s

In the 1980s, Japan was eating America’s economic lunch. Its economy was growing fast, partly as a result of a very expansive monetary policy. Meanwhile a major speculative boom developed in real estate and the stock market on the heels of a highly productive and successful export sector. At the same time, US industrial companies were struggling from stagnating productivity and an overvalued dollar.

Between 1985 and 1991, commercial land prices rose more than 300%, while residential land and industrial land price jumped 180% and 162%, respectively. In 1984, the Nikkei 225 index had largely moved within the 9900–11,600 range. But as land prices in Tokyo began to rise in 1985, the stock market also moved higher. In 1986, the Nikkei 225 gained close to 45% and the trend continued throughout 1987, when it touched as high as 26,000 before being dragged down by New York’s stock market Black Monday. Still, the Nikkei’s strong rally resumed and continued throughout 1988 and 1989, closing near 39,000 at the end of December 1989.

Ben Carlson, now with Ritholtz Wealth Management, states that in the 1980s, share prices increased 3 times faster than corporate profits for Japanese corporations. I think this should serve as a reminder that major market fluctuations generally are more a matter of crowd perceptions than of underlying fundamental values.

Finally, by August 1990, after five monetary tightenings by the Bank of Japan, the Nikkei stock index had plummeted to half its peak. But even though asset prices had already collapsed by early 1992, the economy’s decline continued for more than a decade. This decline resulted in a huge accumulation of non-performing assets loans, causing difficulties for many financial institutions. The bursting of the Japanese asset price bubble contributed to what many call Japan’s Lost Decade.

THE DOT.COM BUBBLE of THE 1990s

This episode is recent enough that many of today’s stock market participants do, or should, remember it.

In the late 1990s, the investing crowd discovered the magical promise of the internet, much as the speculators of yesteryear discovered radio in the 1920s. Just like radio then, the internet was a revolutionary discovery that would change how the world operates. But, just as for radio in the 1920s and beyond, while the innovation was a phenomenal societal and commercial success, only few investors made durable fortunes on it, and those mostly several years later. As far as I can remember, most other sheep-like investing followers lost money on the dot.com bubble when it burst.

In the five years between 1995 and its peak in March 2000, the Nasdaq Composite stock market index rose 400%, only to fall 78% from its peak by October 2002. So, assuming my math is correct, if you timed the bubble perfectly, you earned only 10% in seven years. A majority of investors, however, were drawn in by the allure of the poorly-understood promise of tech and underestimated the challenges of bringing its innovations to commercial success. Naturally, they lost money.

THE SUBPRIME CRISIS AND GREAT RECESSION of 2007-2008

With a little help from Wikipedia, this is a quick summary of what I remember from that episode.

Subprime (lower quality) home mortgage were marketed to clients with low solvency, and therefore with a higher risk of default, who would not have had access to traditional mortgages. Their interest rate was higher than for personal loans, and bank commissions were more burdensome, which made them more attractive and easier to sell for banks and other financial intermediaries – at least for those with a predilection for quick profits rather than long-term value creation.

In that low-interest-rate environment, everyone wanted to share in the fat margins and large new market being opened by subprime mortgages: many brokers and marketing teams “initiated” new loans on behalf of actual banks without proper due diligence on the solvency of the borrowers. Indeed, they often actually encouraged those clients to paint a rosy picture of their finances. The loans were then typically resold by banks to other, less-informed institutions. Eventually, thanks to the creativity of investment bankers and the complacency of rating agencies, mortgages were aggregated in such a way that a package of mortgages with disparate levels of reliability could be sold to the public as an instrument with a superior safety rating. Additionally, In the US, the purchase and sale of housing for speculative “flipping” purposes spread and was accompanied by high leverage, which amplified the ballooning of debt. Often safeguards of prudence and ethics were abandoned.

Eventually, though, the progressive rise in interest rates by the Federal Reserve increased the delinquency rate and the level of foreclosures. From 2004 to 2006 the interest rate went from 1% to 5.25%. The rise in house prices, which had been spectacular between 2001 and 2005, turned into a sustained decline and foreclosures due to the non-payment of debt grew dramatically. Many financial entities experienced liquidity problems and difficulty returning money to investors or receiving financing from lenders.

The mortgage crisis resulted in numerous financial failures, bank nationalizations, constant interventions by the central banks of major developed economies, deep drops in stock prices and general deterioration in the global economy. The US entered a deep recession, with nearly 9 million jobs lost during 2008 and 2009. Its economy did not return to the December 2007 pre-crisis peak until May 2014.

THE 1987 “BLACK MONDAY”

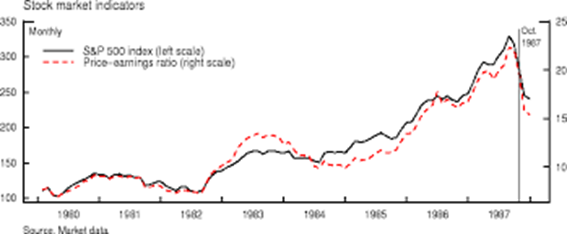

I launched the Tocqueville Fund in early 1987. By that time, the S&P 500 index of the US stock market had taken only five years to nearly triple from its 1982 recession low. At 18x, up from 8x at the 1982 bottom, the index’s price-to-earnings ratio had been multiplied by 2.3, and thus had accounted for a major portion of the advance. At 18 times earnings, the index had not yet reached the 33x multiple at the top of the 1999 dot.com bubble or the “new-age” 36x of early 2021, but it was high by historical standards and enough to make me worry about valuation.

As a result, I kept most of the money from the initial subscriptions into the fund in cash and liquidities. Soon, the early shareholders, who were largely colleagues and friends, caught the FOMO (Fear Of Missing Out) bug and started calling me to say that, if they had wanted to own a money-market fund, they would have invested in one.

Listening to the “voice of the people,” I finally invested much of the fund’s assets in selected stocks … shortly before the fateful Black Monday of October 19, 1987. Then, in one day, the Dow Jones Industrials index fell nearly 23%.

On that day, I was in London making a presentation to a group of institutional investors, who surprisingly all showed up in spite of probably having seen on the hotel lobby televisions, as I had, what was happening in New York.

Back in my room, I called my partner Jean-Pierre Conreur in New York to ask him what he was doing in that financial tempest. He answered: “Not very much, because the tape is hours late and we have no idea of where stock prices are. I am just making lists of companies whose shares we might purchase when the markets function again.” For many stocks, we would only know prices days later. The only thing I could do was to call clients to reassure them that we were watching the markets closely and we were in charge, ready to act when things stabilized.

When the one-day crash was absorbed, we reviewed the various accounts under our management and they were down a bit, but much less that the leading indexes. I felt we were geniuses! But I forgot one thing: in a panic and faced with the need to sell in a hurry, investors sell what they can and that is large stocks with presumably liquid markets, even in a downdraft. Our portfolios, importantly, were in smaller, somewhat less-liquid shares and were initially bypassed by those who’d been forced to sell.

However, by the end of the year, only two months later, our portfolios had caught up with the debacle: they were down less than the market, because they held mostly value stocks with strong balance sheets, but still down for the year. We would have done much better with the cash we had held until I succumbed to the pressure of the “crowd.”

The interesting thing is that subsequent studies of the crash could not trace any immediate cause or trigger. Several excesses should have warned investors to be cautious: economic growth had slowed while inflation was rearing its head. After tripling in value In the five years preceding October 1987, stocks were generally overvalued, with the overall market’s price-earnings ratio above 20 and estimates of future earnings trending lower. Debt levels had increased fast with the ebullient stock market (for example, leveraged buyout activity mushroomed from less than $3 billion annually to more than $30 billion in 1987). The dollar had been declining after the Louvre currency accord, and interest rates had been rising.

However, Nobel-prize winning economist Robert J. Shiller surveyed 889 investors immediately after the crash regarding several aspects of their experience at the time. According to Shiller, the most common responses were related to a “gut feeling” of an impending crash, perhaps brought on by “too much indebtedness.”

But most of these opinions were garnered with hindsight. The truth is that investors were aware of the issues facing the stock market but had become complacent, lulled by innovations such as portfolio insurance (using computer programs and derivatives), which gave them a false belief that it would prevent a significant loss of capital if the market were to crash. In other words, everything was set for a “Minsky Moment” (when a long period of economic and financial stability transforms into a sudden bout of instability) but its timing, as always, remained elusive.

LESSONS OF HISTORY

It may be presumptuous to draw definitive conclusions about financial history from the limited sample of my fifty years on Wall Street. But the few financial bubbles that I witnessed were long to inflate and then exacerbated and extended by economic recessions that were either concurrent with or the consequence of these financial excesses and complacency.

In contrast, the 1987 crash was generally unanticipated or, at least, its early warning signals were largely ignored. It was not accompanied by an economic recession and, maybe for that reason, it was exceptionally short – though still quite painful for investors.

The criteria for asset under- and over-valuation change from period to period. But all financial crises are caused by preceding ebullient markets fed by speculation and the crowd’s fear of missing out on widespread gains (or at least increased complacency in the face of “irrational exuberance.”) The timing of the reckoning is elusive, but seems to be unavoidable in time.

This is why, over time, I have evolved from my training as a pure value investor to my current emphasis on contrarian investing. The economic environment and technologies change, but human nature remains fairly constant in its bipolarity.

Today, again, experts are arguing that an overextended bull market fueled by zero or negative interest rates, computerized/algorithmic trading, SPACs, memes, Bitcoin, FANGs, etc. is justifiable regardless of valuations. The names and concepts may have changed, but experience tells me that the human characteristics of the investing crowd have not. I may not have seen it all, but I have witnessed much of it before and I have survived and reasonably prospered.

François Sicart – October 4, 2021

Disclosure:

The information provided in this article represents the opinions of Sicart Associates, LLC (“Sicart”) and is expressed as of the date hereof and is subject to change. Sicart assumes no obligation to update or otherwise revise our opinions or this article. The observations and views expressed herein may be changed by Sicart at any time without notice.

This article is not intended to be a client‐specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon. This report is for general informational purposes only and is not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally.