Articles

What’s better than a crystal ball?

I wrote an early draft of this article in the first days of 2020. I had no way of knowing what a roller coaster ride awaits us on all fronts: health, economy, everyday life, and of course, investing. I chose to put some final touches, and share it with you now. We might have entered the second half of the year, but our visibility for the following 6-12 months hasn’t gotten much better, but maybe there is a solution to that.

It’s been almost four years since Sicart Associates became an independent investment advisor, and moved into our office on the 54th floor of Carnegie Tower. Before we switched to remote work, and left our office, I remember how we were still finding items that got misplaced in the move. The most recent pre-pandemic rediscovery was a dust-covered crystal ball that used to sit on my partner François Sicart’s desk. We cleaned it, and we returned it to prominent display in his office. I can’t say that it has helped us make better investment decisions, but it definitely reminds us daily of the challenges of predicting the future, and provides a warning against getting overly excited about the prospects of any particular investment.

Superficially, investing success may seem to require predictive abilities. But looking closer to the actual process, we can discern a way to rely less on crystal balls, and more on something we have much more control over.

I am sometimes asked if I think the market will head up or down in a coming year. I just shrug, remembering the highly volatile days we have seen at times. March 2020 was a prime example. The daily swings were dramatic, and completely unpredictable. We had no way to forecast where the market would end up at the close.

With our freshly polished crystal ball, we still don’t claim the ability to tell the future better than anybody else; in fact, we think that the person who does so either fools himself or everyone who cares to listen.

Through our investment experience managing family fortunes over generations, we discovered that we have an absolute control over only three elements of investment success: price, patience, and investment horizon.

We might like a certain business, and want to own it one day, but it is our choice to decide what price we will pay. The market quotes a price every day, but we are not obligated to act on it until the price is right. Ideally, we look for the market to demonstrate healthy skepticism about a company’s prospects, expressed in lowered valuations. We call it – down, cheap, out-of-favor stock. If it’s a quality business selling at lower price, that’s equivalent to finding a favorite brand of shoes marked down 50% during a promotion. The discount probably won’t last, and since we are paying a lot less for something we want, the risk of making a poor decision is lower. In fact, the lower the price we pay for a stock, the lower the risk. The more we pay for the stock, the higher the risk.

We can’t predict the future, but the lower the price we accept, the less certain we have to be about the future. Any future improvement in a stock’s price probably points to an investment success. The opposite is true if we overpay for a quality business. Let’s say we buy a stock whose price quintupled in the last five years. It’s widely expected to double and triple again. The predictions had better come true, because now we’re not just running a big risk of being wrong and not capitalizing on the expected upside, but we could also be exposed to a massive loss, when the company disappoints.

As value investors focused on paying less to get more, we play up to our strengths, i.e. our ability to analyze the quality of the business, and our discipline in buying it at the right price.

Over the years we have learned that it takes great patience to not only wait to buy the stock, but also to see it recover and perform up to its potential. Beyond that, we need even more patience not to sell it too early. We like to think of ourselves as patient value buyers and patient growth holders.

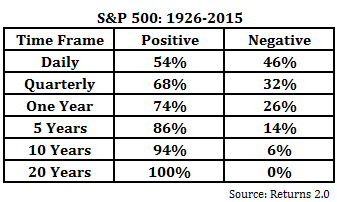

An ” investment horizon” is a fascinating concept. If you shrink it to a day, statistically you have an almost 50:50 chance of correctly guessing if any trading day will be an up or a down day. If you extend your investment horizon to 3-5 years or even a decade or more, your odds of a positive return go up dramatically.

In my first book, Outsmarting the Crowd, I wrote, “Investing is dealing with imprecise assumptions tainted by an imperfect world haunted by uncertainty.” I further added, “If you accept some imperfection, and imprecision in this uncertain world, some really important conclusions become clear.”

What are they? The lower the price you pay, the lower the risk, and the less you need to worry about predicting the future. The more patient you can be, the more investment opportunities will become available to you. Finally, the longer the investment horizon you choose, the higher the odds of success you will have.

If you are looking for certainty, we believe that impatiently buying stocks at any price, and hoping to see quick results is an inevitable path to eventual investment trouble.

Even if you took our shining crystal ball away, we will do just fine sticking to our investment discipline: buying stocks cheaply, patiently waiting for them to perform, and keeping our investment horizon as long as possible.

Happy Investing!

Bogumil Baranowski

Published:

Disclosure:

The information provided in this article represents the opinions of Sicart Associates, LLC (“Sicart”) and is expressed as of the date hereof and is subject to change. Sicart assumes no obligation to update or otherwise revise our opinions or this article. The observations and views expressed herein may be changed by Sicart at any time without notice.

This article is not intended to be a client‐specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon. This report is for general informational purposes only and is not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally.